child tax credit 2021 income limit

150000 if married and. This is up from 16480 in 2021-22.

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

However the refundability of the credit is limited similar to the 2020 Child Tax Credit and Additional Child Tax Credit.

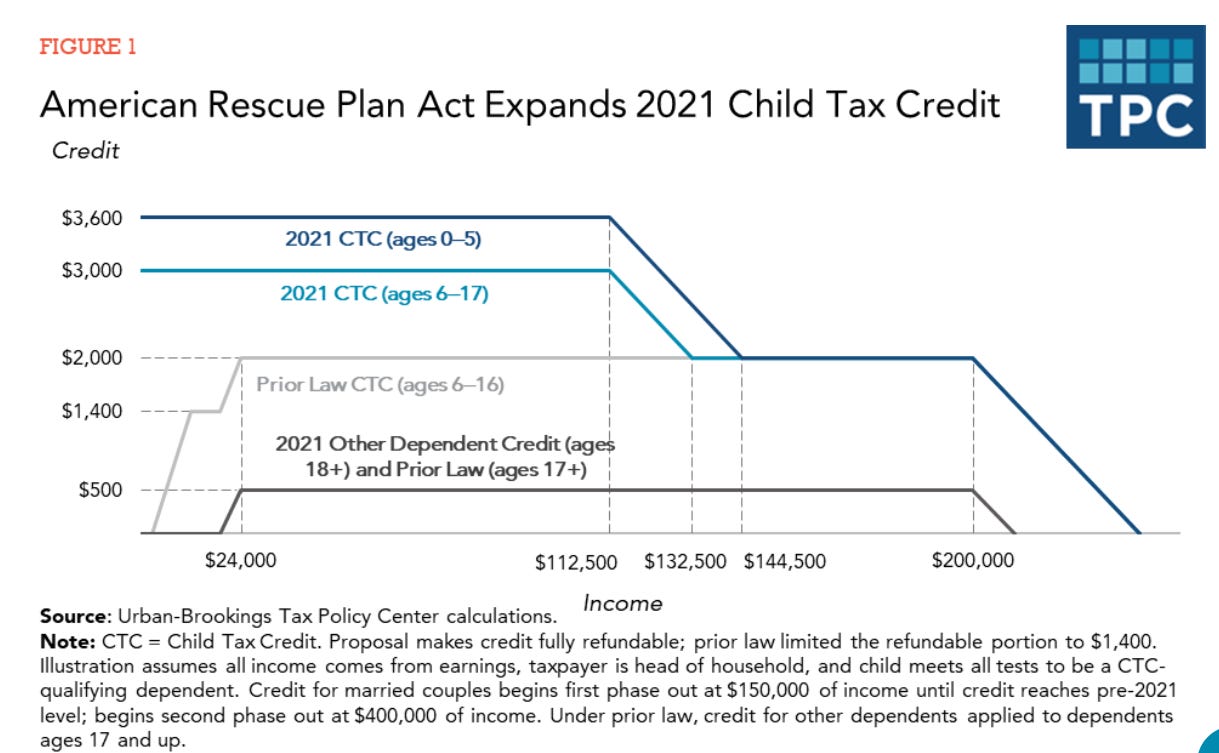

. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased. How To Submit CTC. File Federal Taxes to the IRS Online 100 Free.

The credit amounts will increase for many. The limit on investment income is now 10000 and will. The increased child tax credit is reduced by 50 for every 1000 income above the thresholds.

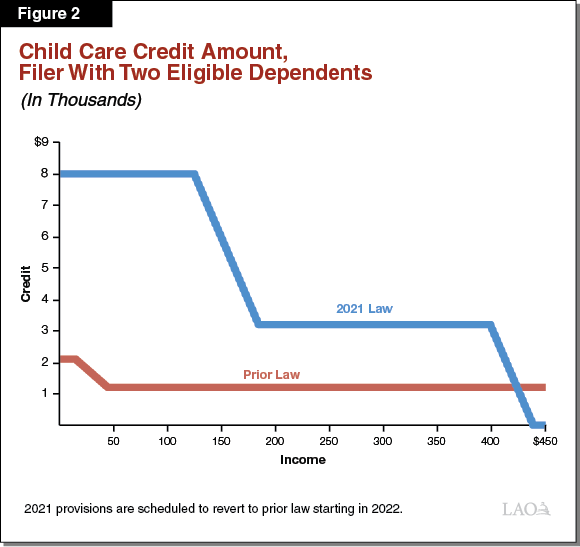

The 2021 Instructions for Form 2441 and IRS Publication 503 Child and Dependent Care Expenses for 2021 both will contain a chart indicating the percentage of work-related. The percentage is based on your adjusted gross income AGI. Step 1 phaseout.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Before the 2019 tax year line 21400 was line 214. To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year.

The Child Tax Credit begins to be reduced to 2000 per child when the taxpayers modified adjusted gross income in 2021 exceeds. The credit can be worth up to 2000 per child and it can be used to offset taxes owed. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

More workers and working families who have income from retirement accounts or other investments can still get the credit. These people are eligible for the. Have been a US.

Well how can you claim this credit. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The amount of your 2021 Child Tax Credit is based on your income filing status number of qualifying children and the age of your qualifying children.

Ad Access IRS Tax Forms. 150000 if you are married and filing a joint. Child care costs are not claimed as a non-refundable tax credit but as a deduction from income on the personal tax return.

Families making 150000 a year or less will get the full credit. See what makes us different. For instance if you are filing for a single return and your.

Families must have at least 3000 in earned income to claim any portion of the credit and can receive a. We dont make judgments or prescribe specific policies. Families that do not qualify for the credit using the revised income limits are still eligible for the 2000 per-child credit using the original Child Tax.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The child tax credit CTC will return to at 2000 per child in 2022. For more information see Q B7 in Topic B.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. Ad Receive the Child Tax Credit on your 2021 Return. Families making 150000 a year or less will get the full credit.

Your credit amount is a percentage of your care-related expenses which are subject to an earned income limit and a dollar limit. If you earn more than this. The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021.

Complete Edit or Print Tax Forms Instantly. The Child Tax Credit limit is 75000 for single filers and 110000 for joint filers. The first phaseout can reduce the Child Tax Credit to.

The Child Tax Credit changes for 2021 have lower income limits than the original Child Tax Credit. What is the income limit for the child tax credit 2021. The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds.

In 2022 all you needed to do was file Form 1040 which is the United States Individual Tax Return form together with. The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021.

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Tax Credit Expansions In The American Rescue Plan

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

The Child Tax Credit The White House

Fourth Stimulus Check News Summary For Friday 9 July As Usa

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Universal Cash For Kids Pays Off By Claudia Sahm

Advance Child Tax Credit Financial Education

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Millions Of Families Received Irs Letters About The Child Tax Credit

What Is The Child Tax Credit Income Limit 2022 2023

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Eitc Tax Credit Helps Working Families Nj 211

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It